Bepace at the ICE 2022 London Gaming

Discover the Bepace Business Certification Label and Trust Index at the ICE London 2022 Gaming Expo (12-14 April 2022) and take advantage of an industry that is full of

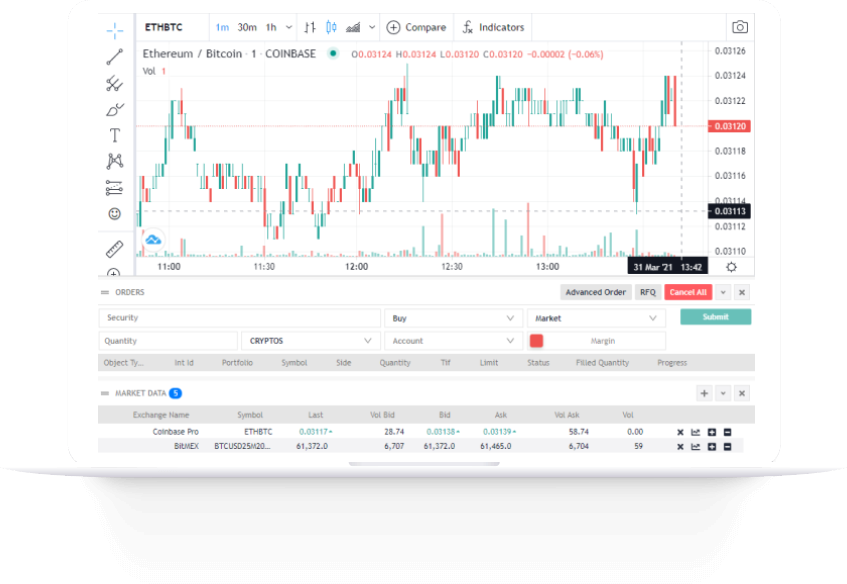

Support for hundreds of cryptocurrencies including Bitcoin, Ethereum, Ripple, Litecoin, Dash and more

Processing of live market data from any of the supported cryptocurrency exchanges

Trading of cryptocurrencies based on automated trading rules such as technical indicators or statistical arbitrage

Automated download of accounts, exchanges and currency pairs into AlgoTrader

Simultaneous trading of currency pairs on multiple exchanges

Trading of cryptocurrencies against fiat currencies through Forex brokers such as FXCM, LMAX and Currenex

Simulation / Paper Trading of cryptocurrency trading strategies in live trading

Support for exchange and margin trading

Automatic withdrawals and deposits, i.e. automatic re-balancing of cryptocurrencies across exchanges

Account/Deposit events via WebSocket

Handling of Crypto fees

Crypto adapter order reconciliation on WebSocket reconnect

Encryption of API keys

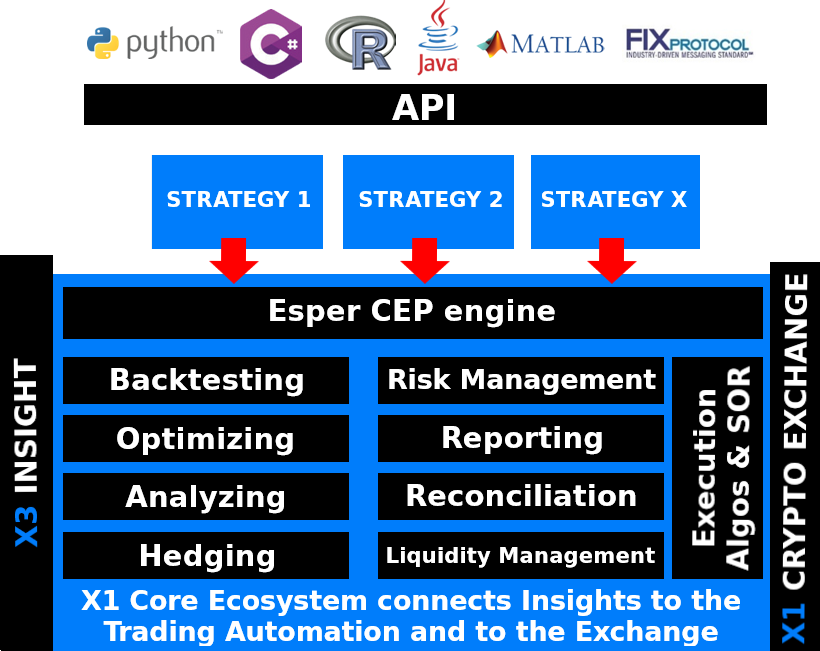

The new Bitcoin and cryptocurrency trading features are particularly useful for Bitcoin funds and Bitcoin brokers.

Execution of large cryptocurrency orders via pre-built execution algorithms

Automated cryptocurrency market making

Arbitrage trading of cryptocurrencies between multiple cryptocurrency exchanges

Automated rebalancing of cryptocurrency portfolios.

XI Trading Automation has a direct API to X1 Crypto Exchange, Binance, Bitfinex, BitFlyer, Bithumb Pro, BitMex, BitStamp, Coinbase Pro, Deribit, Huobi spot, Kraken spot, OkEx / OkCoin, RFQ adapters to B2C2 and Tilde/Grasshopper, historical data adapters to CoinAPI and CoinMarketCap, as well as live market data from CoinAPI.

Discover the Bepace Business Certification Label and Trust Index at the ICE London 2022 Gaming Expo (12-14 April 2022) and take advantage of an industry that is full of

Crypto companies still awaiting U.K. regulatory approval are looking abroad with only three days until a government deadline, prompting industry concerns of an impending exodus

Skechers will build a virtual store on Decentraland’s Fashion Street Estate. Despite the positive development, MANA is struggling to find momentum in the market. The

By Ipek Ozkardeskaya, Senior Analyst | Swissquote Coinbase’s debut in Nasdaq didn’t help boosting appetite in technology stocks. Coinbase nearly doubled its reference price of

By Ipek Ozkardeskaya, Senior Analyst | Swissquote Investor sentiment remains mixed faced with the strong jobs report pointing that the Federal Reserve’s (Fed) substantial progress

by Ipek Ozkardeskaya, Senior Analyst | Swissquote The Archegos story continues sitting at the headlines of the financial news, as investors question whether the fall