Crowdfunding in Europe 2025: A Thriving €1B Industry Empowering Startups and SMEs

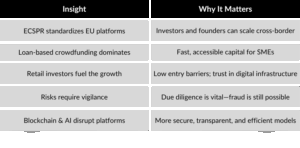

Crowdfunding is no longer just a buzzword. In 2025, it’s a central pillar of Europe’s alternative finance ecosystem, empowering businesses and investors alike.

What is Crowdfunding & Why It Matters?

Crowdfunding is a way for businesses, creators, or causes to raise capital by collecting small contributions from a large number of people—typically via digital platforms.

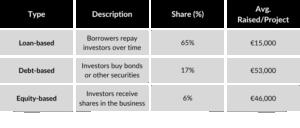

Main Types of Crowdfunding in the EU

Retail investors dominate this space, making up 87% of users with an average investment of €590 per person.

Country-by-Country Crowdfunding Leaders

The European market is geographically diverse. Let’s explore where the action is:

France & Netherlands Lead the Way

With nearly €300M raised annually each, these countries are mature crowdfunding hubs.

Lithuania Surprises

Although small, Lithuania has one of the most active retail investor bases in Europe. Its early adoption of fintech-friendly laws fostered a booming crowdfunding scene.

Estonia as a Tech Trailblazer

Estonia’s digital-first ecosystem has helped crowdfunding flourish – although past platform failures prompted tighter regulations.

Switzerland

Very safe and well regulated crowdfunding market with some interesting initiatives like the multi-asset private capital peer-to-peer platform by CapiWell.

ECSPR: The Legal Backbone of Crowdfunding in Europe

At the heart of European crowdfunding regulation is Regulation (EU) 2020/1503, known as ECSPR (European Crowdfunding Service Providers Regulation), which came into full force in November 2021.

Objective: To remove legal fragmentation and create a harmonized framework enabling crowdfunding platforms to operate across the EU under a single license.

1. The Investor’s Perspective

Protections Available

- Platforms are required to provide a Key Investment Information Sheet (KIIS) for each campaign. This standardized summary includes information about risks, the business model, financial forecasts, and governance.

- Platforms must conduct a suitability test for retail investors and provide a mandatory reflection period of four calendar days before confirming investments.

- Risk warnings must be prominent, and in some cases, platforms suggest soft investment caps for retail clients (though not mandatory under ECSPR).

Key Legal Risks for Investors

- High default risk in loan-based crowdfunding.

- Limited investor rights in case of project failure or issuer bankruptcy.

- Illiquid secondary markets for exiting equity or debt positions

Additional Considerations

- Investor protections vary depending on the jurisdiction where the platform is regulated.

- Tax treatment of returns (dividends, interest, capital gains) differs across EU member states, with no harmonized regime.

2. The Platform’s Perspective

Regulatory Requirements under ECSPR

- Platforms must obtain authorization from a National Competent Authority (NCA), such as BaFin in Germany, SO-FIT in Switzerland or KNF in Poland.

- Once authorized, platforms can operate across the EU through a “passporting” mechanism.

- Required documentation includes an operations manual, risk mitigation strategy, conflict of interest policy, and client communication procedures.

- Platforms may not hold client funds unless separately licensed under MiFID II or PSD2 as a payment or investment institution.

Legal Liabilities

- Misrepresentation of project details or omission of risks in a KIIS may result in civil liability.

- Regulatory breaches can lead to fines, reputational damage, and loss of license.

Legal Challenges

- Unclear legal treatment of secondary markets. The resale of crowdfunding instruments is not harmonized and may fall under MiFID II.

- Platforms must monitor whether a campaign exceeds the €5 million per year threshold, beyond which prospectus requirements under capital markets law apply.

3. The Entrepreneur/Issuer’s Perspective

Obligations to Comply With:

- Issuers must produce a transparent and accurate KIIS.

- Compliance with national corporate law remains necessary, including company registration, shareholder rights, reporting duties, and board structure.

- In equity crowdfunding, entrepreneurs must manage a larger, often retail-oriented shareholder base, with necessary updates to the company’s articles of association or shareholder agreements.

Fundraising Limits

- ECSPR allows entrepreneurs to raise up to €5 million per project per year. Exceeding this limit subjects the offer to prospectus and capital markets law.

Jurisdictional Strategy

- Entrepreneurs may choose to incorporate in EU countries with favorable legal frameworks for startups and crowdfunding, such as Lithuania, Estonia, or the Netherlands.

Equity Management Complexities

- Shareholder agreements must account for investor protection clauses such as drag-along, tag-along, and voting rights.

- Post-campaign management, such as communication with hundreds of investors, requires internal governance mechanisms or nominee structures.

4. The Regulator’s Perspective

Primary Objectives

- Protect retail investors

- Ensure market transparency and integrity

- Enable cross-border capital formation for SMEs

- Combat money laundering and financial crime

Key Authorities Involved

- ESMA (European Securities and Markets Authority) coordinates implementation across the EU, issues interpretive guidance, and updates Q&A.

- National regulators (e.g., AMF, BaFin, CNMV, SO-FIT in Switzerland) grant authorizations, supervise ongoing compliance, and enforce sanctions if needed.

Emerging Concerns in 2025

- Integration of blockchain and tokenized instruments, which challenge traditional licensing structures.

- Cross-border regulatory enforcement in fraud cases, especially with platforms operating from low-regulation countries.

- ESG claims and sustainability disclosures are increasingly scrutinized under new sustainability reporting obligations (e.g., CSRD).

Trends Driving Growth in 2025

Rise of Impact & Sustainability Crowdfunding

Platforms like Goteo.org are merging open-source philosophy with climate and social impact projects.

Tokenization & Blockchain Integration

Projects are now exploring security tokens and blockchain-based audits for real-time transparency and compliance.

Automation of Compliance

New crowdfunding platforms are embedding AI-driven risk analysis, KYC, and ESG scoring—reducing cost and bias.

Key Takeaways

Ready to Crowdfund or Invest?

Whether you’re a startup seeking funding or an investor exploring the next innovation frontier, crowdfunding in Europe has never been more exciting—or more regulated.

Learn more at Exporis.ch or get in touch to discuss your next cross-border crowdfunding move.